Tax Insurance Services in Hubb

Comprehensive Tax Insurance Services in Hubb to Protect Your Business

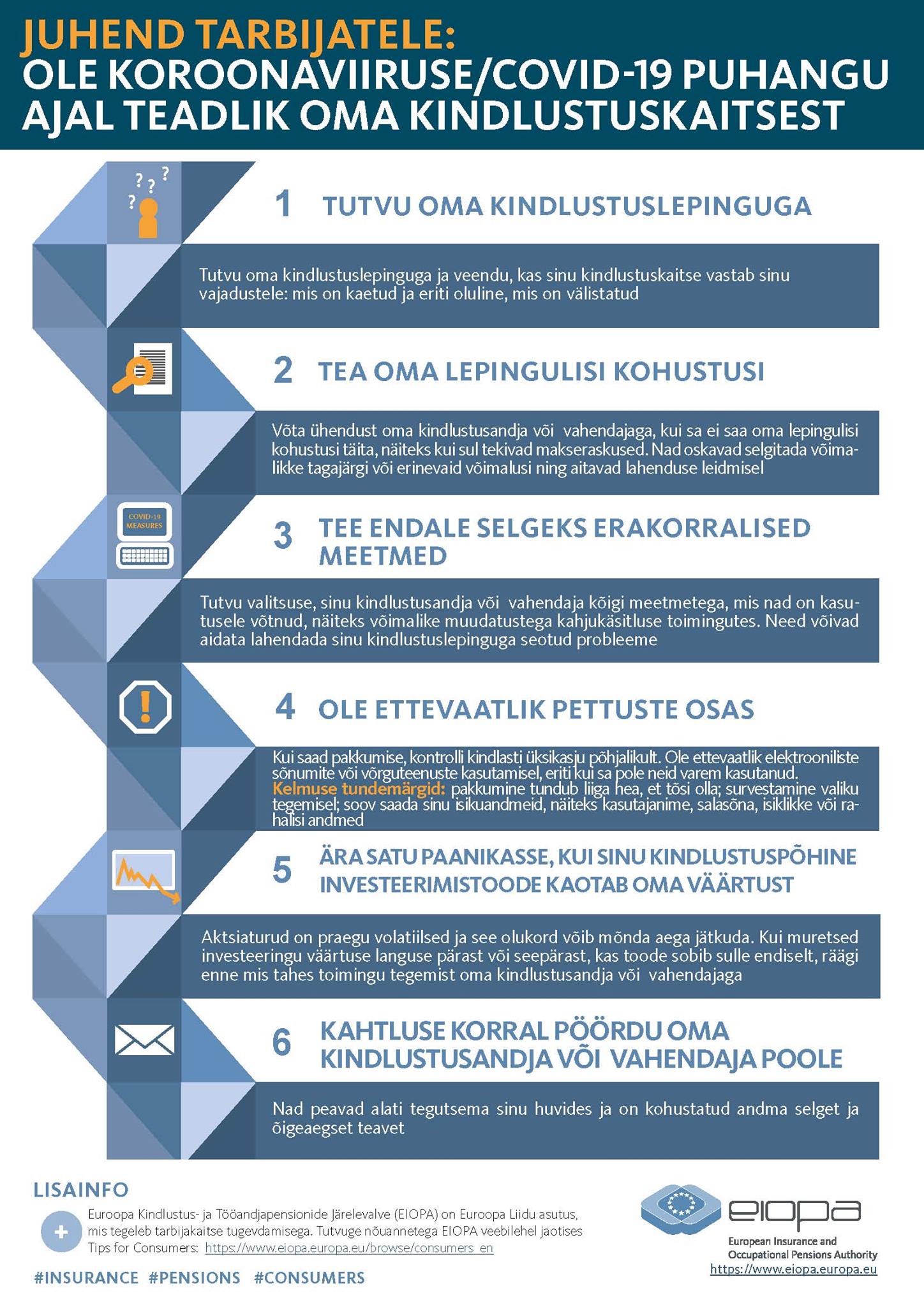

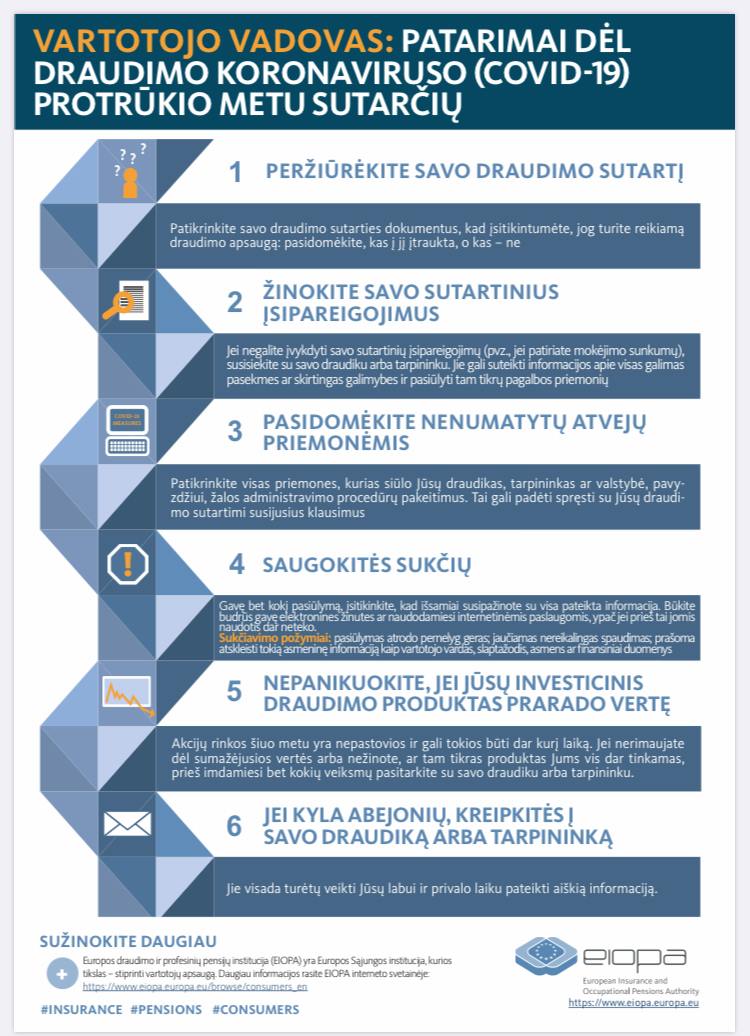

Tax insurance in Hubb offers a strategic way for businesses to manage the risk of unexpected tax liabilities. Whether you’re dealing with tax audits, disputes, or the potential for back taxes, our tax insurance services provide peace of mind by covering a wide range of tax-related risks. Protect your assets and ensure your business remains compliant with ever-changing tax laws.

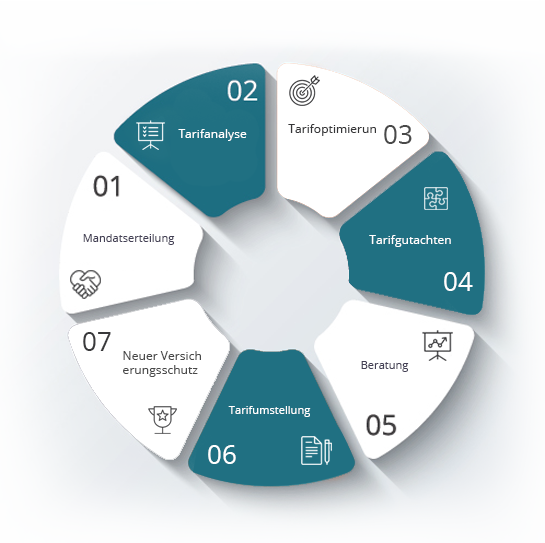

Our tax insurance services in Hubb include:

- Tax Audit Insurance: Protection against the costs and potential penalties arising from a tax audit, including legal fees and settlement costs.

- Tax Liability Insurance: Coverage that shields your business from unexpected tax liabilities, including back taxes or fines due to tax errors or misinterpretations.

- Tax Controversy Insurance: Protection for businesses facing disputes with tax authorities, covering the cost of litigation and any settlements required.

- Indirect Tax Insurance: Coverage for risks associated with value-added tax (VAT), sales tax, and other indirect tax liabilities, ensuring you're protected in case of disputes.

- Transfer Pricing Insurance: Safeguards businesses from the risk of penalties and adjustments related to transfer pricing regulations, ensuring compliance in cross-border transactions.

- International Tax Insurance: Specialized coverage for multinational companies, managing the complexities of global tax laws and protecting against unforeseen tax risks in different jurisdictions.

Protect Your Business with Tax Insurance Solutions in Hubb

Our expert team in Hubb offers tailored tax insurance solutions to mitigate the financial risks associated with tax audits, disputes, and liabilities. With comprehensive coverage options, we help businesses stay ahead of potential challenges, ensuring both financial protection and operational continuity.

Contact us today to learn more about tax insurance services in Hubb. Safeguard your business from unforeseen tax liabilities and maintain compliance with the evolving tax landscape.

Post ad

Post ad